This has been in operation for over decades and has earned Tesla Motors a significant amount in revenue. The supplier management service strategic business unit is a cash cow in the BCG matrix of Tesla Motors. This will help increase the sales of Tesla Motors. This could be done by improving its distributions that will help in reaching out to untapped areas. Tesla Motors should use its current products to penetrate the market. The overall category is expected to grow at 5% in the next 5 years, which shows that the market growth rate is expected to remain high. It also the market leader in this category. The Number 2 brand Strategic business unit is a star in the BCG matrix of Tesla Motors as Tesla Motors has a 20% market share in this category.

This will help Tesla Motors by attracting more customers and increases its sales. Tesla Motors should undergo a product development strategy for this SBU, where it develops innovative features on this product through research and development. The potential within this market is also high as consumers are demanding this and similar types of products. The Number 1 brand Strategic business unit is a star in the BCG matrix of Tesla Motors, and this is also the product that generates the greatest sales amongst its product portfolio. This will help it in earning more profits as this Strategic business unit has potential. Tesla Motors should vertically integrate by acquiring other firms in the supply chain. Tesla Motors earns a significant amount of its income from this SBU. It operates in a market that shows potential in the future. The financial services strategic business unit is a star in the BCG matrix of Tesla Motors. The analysis will first identify where the strategic business units of Tesla Motors fall within the BCG Matrix for Tesla Motors. The BCG Matrix for Tesla Motors will help Tesla Motors in implementing the business level strategies for its business units. The business should divest these strategic business units.

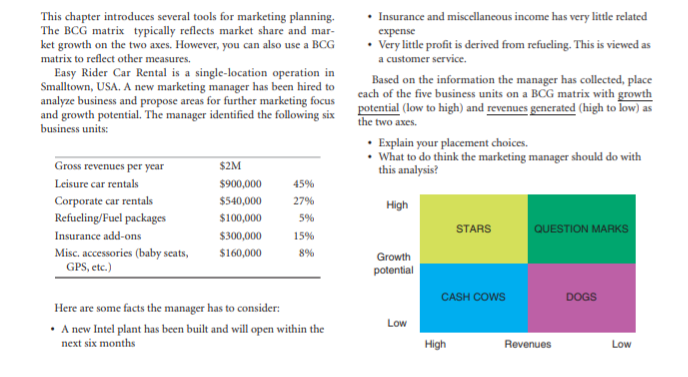

Lastly, the strategic business units with low market growth rate and low relative market share are called dogs. The business should invest in these to maintain their relative market share. Strategic business units with low market growth rate but with high relative market share are called cash cows. These strategic business units require close considerations whether the business should continue with them or divest. Strategic business units with high market growth rate and low relative market share are called question marks. Businesses should invest in their stars and can implement vertical integration, market penetration, product development, market development, and horizontal integration strategies.

Strategic business units with high market growth rate and high relative market share are called stars. The BCG matrix for Tesla Motors will help decide on the strategies that can be implemented for its strategic business units. Strategic business units are placed in one of these 4 classifications. The other of these dimensions is the relative market share of the strategic business unit. These first of these dimensions is the industry or market growth. The matrix consists of 4 classifications that are based on two dimensions. The BCG matrix is a strategic management tool that was created by the Boston Consulting Group, which helps in analysing the position of a strategic business unit and the potential it has to offer.

0 kommentar(er)

0 kommentar(er)